It is also important to remember there will still be transaction fees imposed by the seller for many investments. These higher fees are somewhat offset by Equity Trust waiving its transaction fees, so you may save overall compared to an SDIRA company that charges per transaction.

There are also separate annual membership fees if you want a Gold level service ($249) or a Gold level service prime ($499) membership, which provides access to additional resources and expedited customer service.

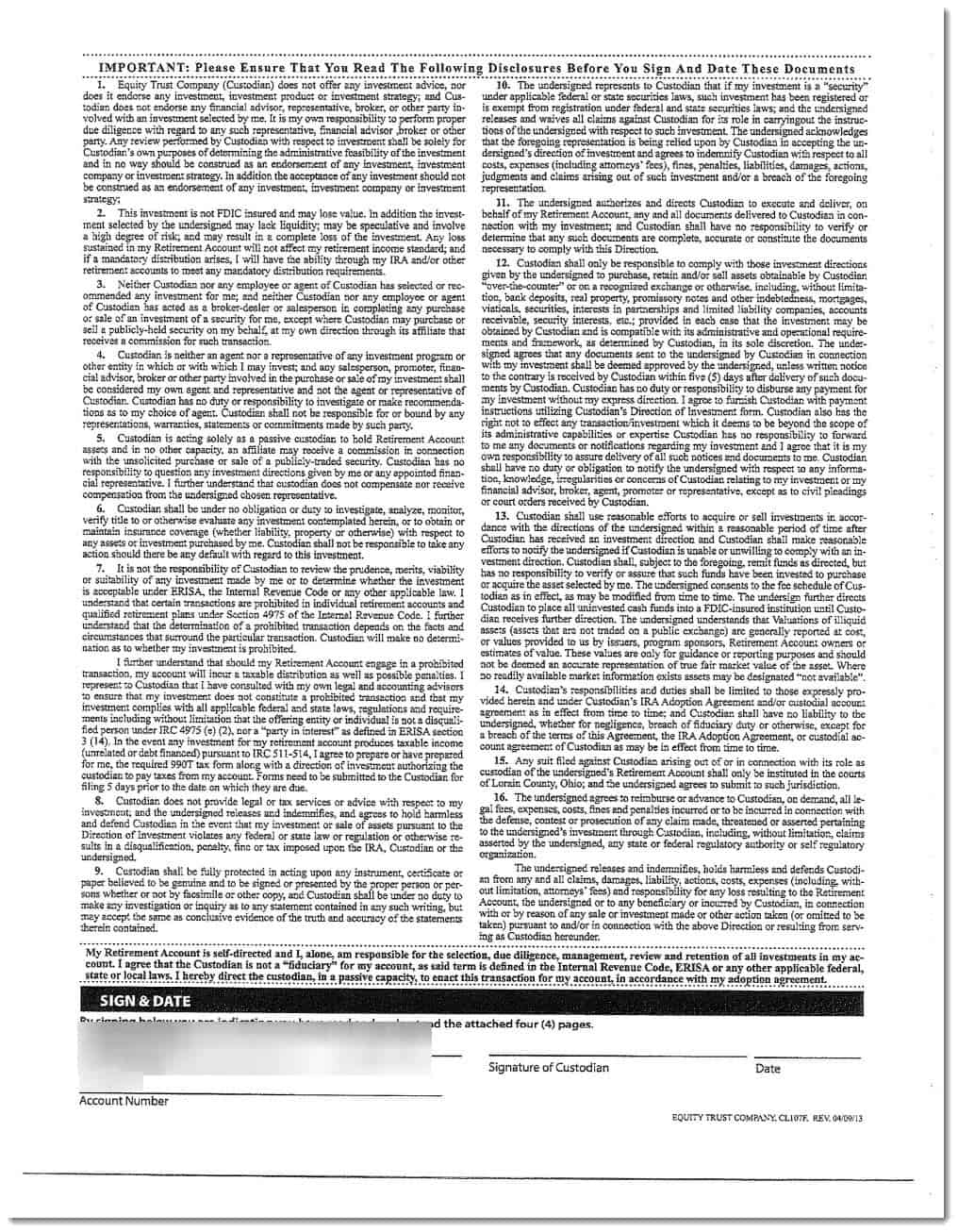

This is particularly noticeable on the lower end of the assets under management. On the downside, the fees are higher than some of its competitors. There is, of course, a thick paragraph of legal text at the bottom of each page that amounts to “do your own due diligence, we are not endorsing this investment.” All the self-directed IRA companies share this approach and it is not hard to find examples of self-directed IRAs being the vehicle mentioned as part of a securities fraud filing.Įquity Trust has experience on its side, good customer service, and a decent platform for managing your investments. The company also offers up the usual mutual funds, stocks, and ETFs that you would find at a regular brokerage.Įquity Trust hosts an “Investment District” on its site that provides clients with some providers that can give simplified exposure to alternative investments. Equity Trust has built on this real estate base to offer support for more niche investments, including private equity, promissory notes (private debt), and cryptocurrencies. Direct ownership of real estate is an alternate investment that many people feel more comfortable with than perhaps even the traditional financial market assets. Like many of the companies offering self-directed IRAs, a lot of Equity Trust’s resources and experience are rooted in the real estate space. This means you do not have direct checkbook control like some other self-directed IRA providers. The Equity Trust arrangement is the traditional custodian relationship where you direct the custodian to make investments on your behalf. It is important to note that the account holder is ultimately responsible for due diligence on all investments and overall compliance with IRS rules, so this type of account is meant for investors with a high level of investment experience.Įquity Trust has a long history and is one of the larger non-bank custodians offering self-directed IRAs to regular investors. When assessing the best self-directed IRA companies, we prioritized support in setting up and managing the legal obligations and the reputation of the company as much as the range of investment options and the fees involved.

Unfortunately, the alternative investment arena also tends to attract bad actors.

Self directed checkbook ira custodian full#

This runs the range from real estate to precious metals to digital currencies and everything in between.Īccessing the full power of a self-directed IRA generally requires working with a custodian rather than an established brokerage, as the latter tend to restrict their SDIRAs to financial market assets.

Pure self-directed IRAs can be set up to invest in private placements (investments in private companies) that focus on any alternative asset you can imagine. Self-directed IRAs give experienced investors the ability to go beyond the regular mix of stocks, bonds, and funds that are staples within traditional investment portfolios. Self-directed individual retirement accounts (SDIRA) are intended to open up retirement portfolios to the full range of alternative assets.

0 kommentar(er)

0 kommentar(er)